Holding off on home repairs

86% of homeowners are delaying home repairs for financial reasons (Survey)

Key findings

- The average home needs $3,150 worth of repairs that haven’t been made yet.

- Only 41% of homeowners could afford a $500 repair out of pocket, and only 28% could say the same for a $1,000 repair.

- Approximately 1 in 4 homes are in need of serious repairs, while 45% of homes are less safe as a result of neglected repairs.

Being a homeowner comes with many responsibilities and just as many headaches. Beyond the consistent maintenance and upkeep, unexpected issues and costly repairs are bound to arise. When time and money are in short supply, it can be easy to save those repairs for another day — but what if that day never comes?

We wanted to understand how many people are delaying much-needed home repairs and why they haven’t yet addressed these issues. To this end, we surveyed 1,078 homeowners to learn the kinds of repairs their homes required, why they’d been put on hold and the real costs of homeownership.

What’s the holdup?

Occasional repairs are simply a fact of life. Homeownership requires a certain degree of comfort with imperfections, but are homeowners living with more issues than they should be?

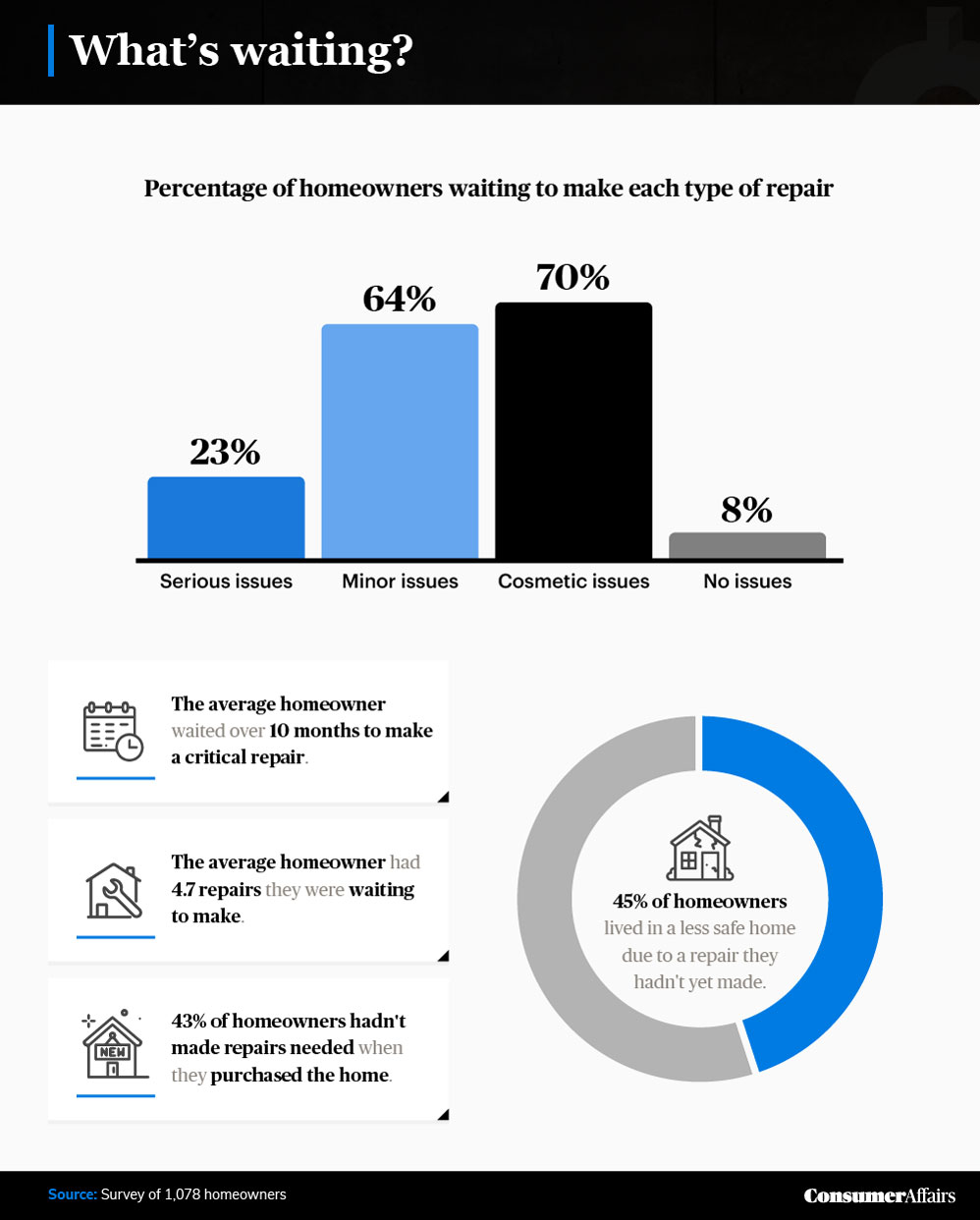

In total, 92% of homeowners had outstanding repairs on their to-do list. Nearly a quarter (23%) said they were currently waiting to fix a serious issue, while about two-thirds (64%) said their problems were minor. On average, homeowners waited over 10 months to make a critical repair — but given how much it costs to maintain a home in the first place, procrastination is understandable.

While some repairs might be easy to to ignore, others can have serious consequences if left unaddressed for too long. Many issues worsen over time, causing further damage and even posing health and safety concerns. In fact, 45% of homeowners surveyed were living in a home they felt was less safe due to a repair they hadn’t made.

We found it particularly interesting that 43% of homeowners were still living with repairs that were needed when they bought their home — a logical time to make repairs but also when buyers tend to feel short on cash. So, exactly what types of issues were our respondents avoiding?

Common home repair issues

With costs continuing to rise for essential items, it’s no wonder that homeowners feel apprehensive about or unable to pay for repairs. Every house is different, and some need more work than others, but we wanted to get a sense of which issues were most likely to be left unaddressed.

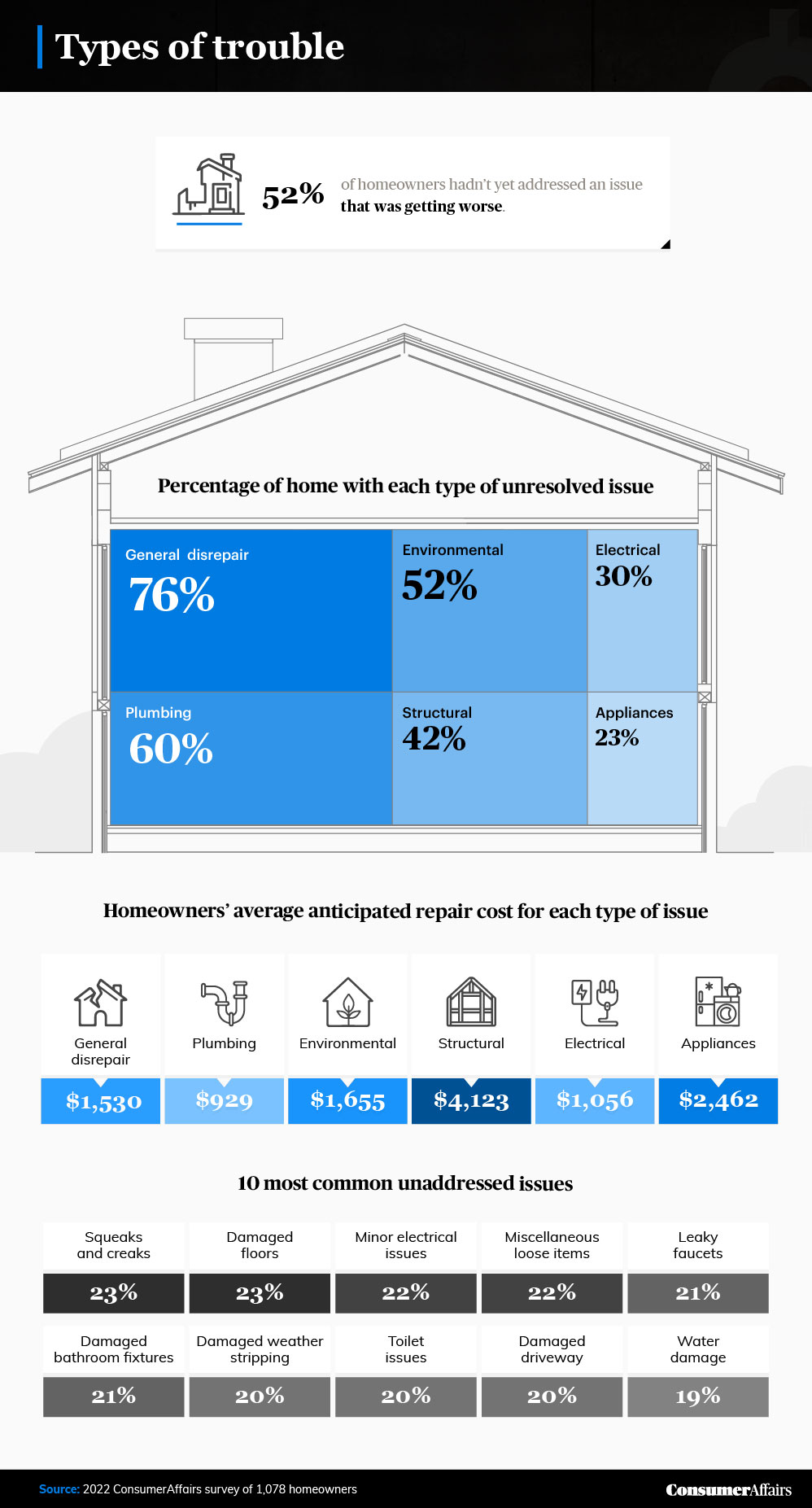

Seventy-six percent of respondents’ homes showed signs of general disrepair such as blemishes, loose doorknobs and sticky locks. Fortunately, many of these small repairs can easily be fixed by the average homeowner.

Homeowners were twice as likely to have a pending plumbing repair (60%) than an electrical repair (30%), while more than half were dealing with issues related to environmental factors, such as water intrusion or termites. Forty-two percent of homes had unresolved structural damage.

According to 52% of homeowners, at least one of their problems was getting worse with time. Even if damage seems minimal or under control, however, it can be a sign of a larger issue.

Repair hesitation

It’s generally wise to go into homeownership with money set aside for emergencies. How much you should allocate to maintenance and repairs depends on many factors, but budgeting is a crucial step — and you can follow some of our tips to make regular home maintenance more manageable. The fact is, though, many homeowners find themselves unable to afford repairs, no matter how much they try to save.

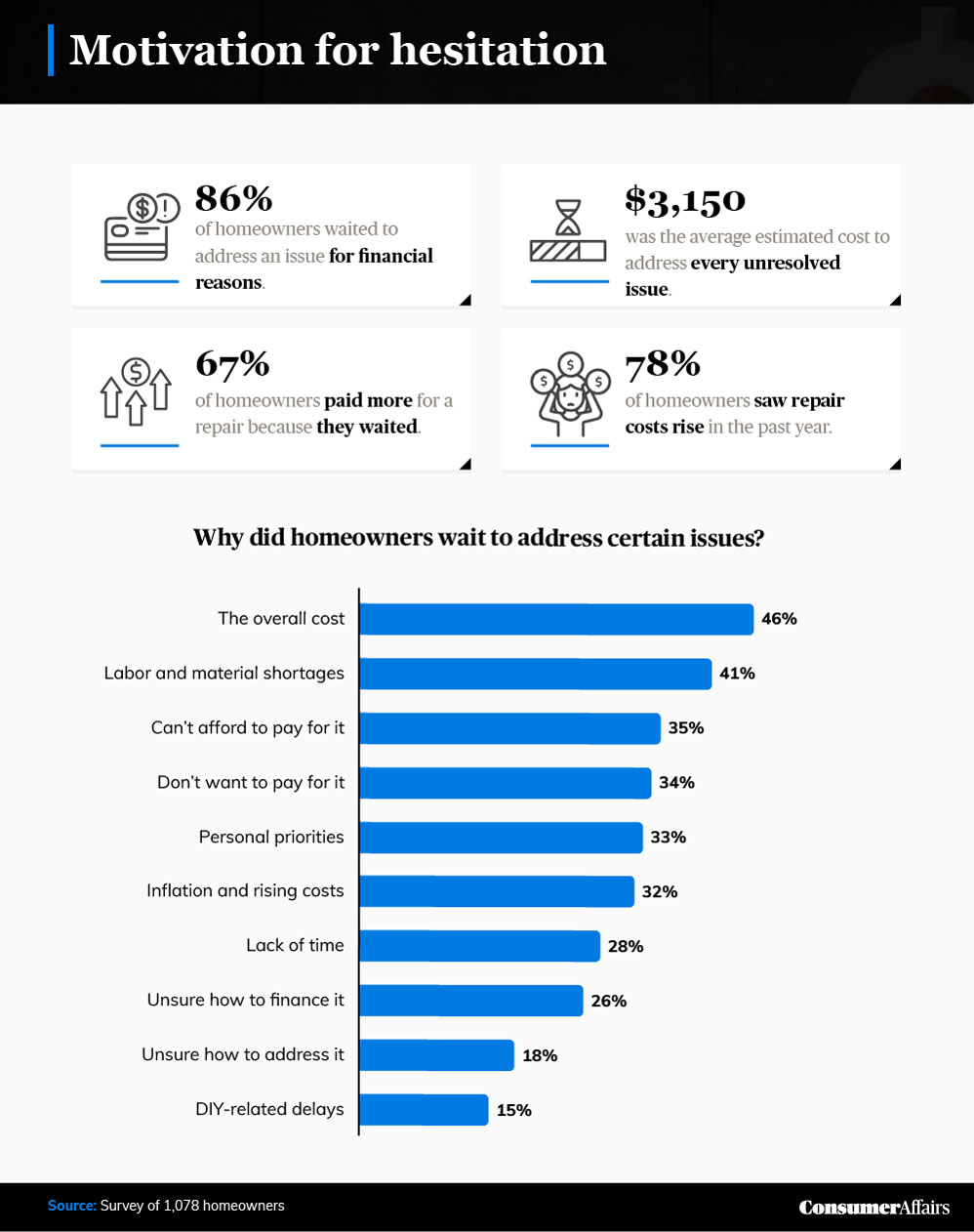

On average, respondents estimated it would cost a total of $3,150 to repair every issue in their home. That’s more than three times the median mortgage payment in 2019. Unsurprisingly, 86% of homeowners in our study said they were waiting on repairs for financial reasons.

The overall cost was the primary reason for avoiding repairs (46%), while more specific financial concerns included an inability to afford the repair (35%) and simply not wanting to pay for it (34%). Approximately one third of homeowners (32%) were holding off due to rising costs, which can put repairs out of reach or make them seem less worthwhile. For approximately 2 in 5 homeowners, labor and material shortages were preventing them from tackling repairs.

With inflation affecting daily life and housing costs continuing to rise, it’s no wonder that financial factors were the most common reason cited for holding out on home improvement.

Concerned about cost

Inflation impacts all aspects of life these days, and it’s starting to put a serious damper on how Americans spend their money. With the cost of everything going up, it’s understandable that people are avoiding home repairs for financial reasons, especially in an effort to more easily afford necessities. Still, with home repairs often being time-sensitive, we wanted to get a sense of the extent to which respondents would be able to pay for repairs if they had to.

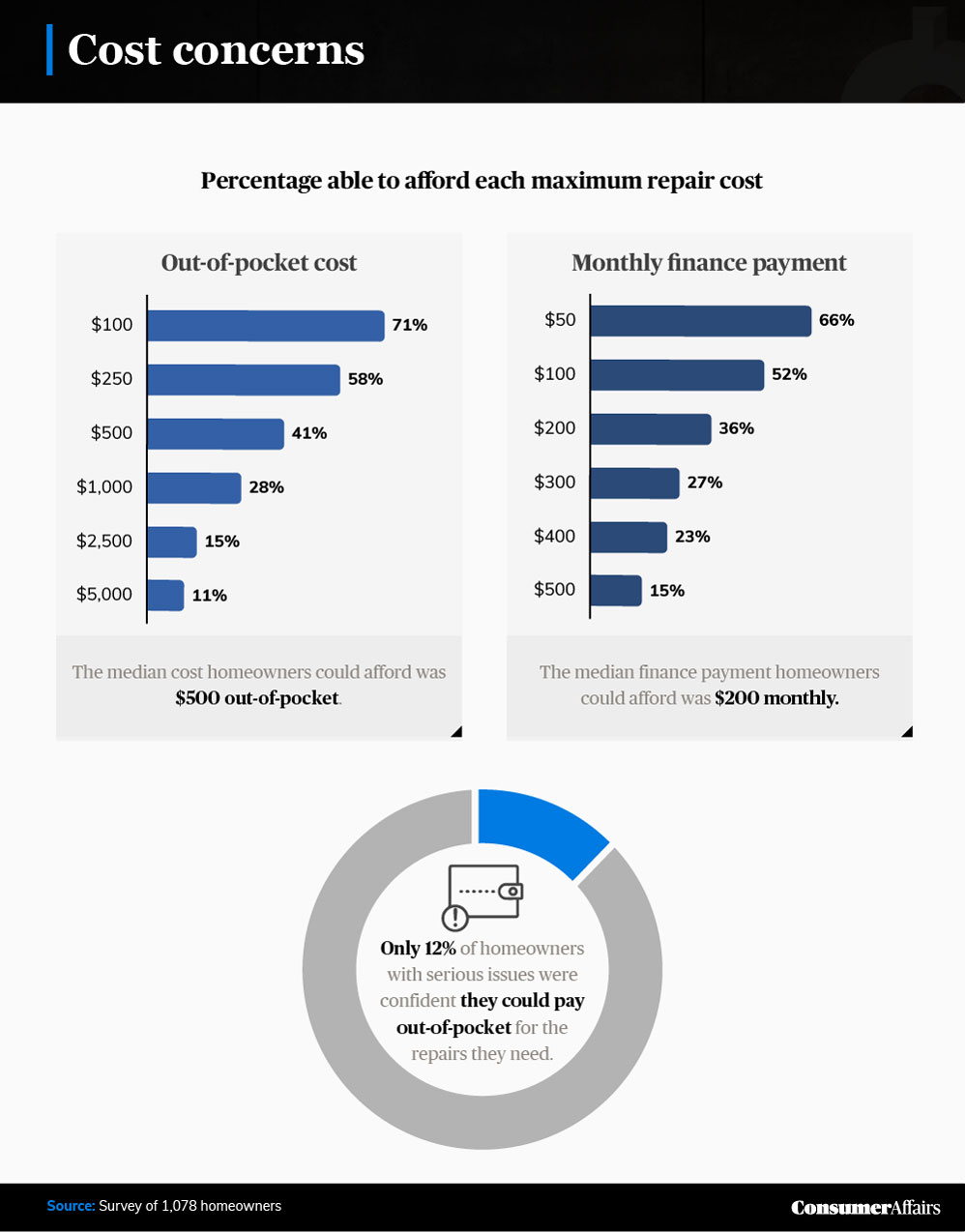

Perhaps the most telling takeaway of our study was the fact that just 12% of respondents with serious home repair issues said they were confident they could fix them without borrowing money.

So how much can most homeowners afford? Not much. The median out-of-pocket cost respondents could afford was $500, while fewer than 3 in 10 could fund a $1,000 repair. At a time when an estimated 61% of Americans are living paycheck to paycheck, these findings are unfortunately not surprising.

Homeowners who find themselves unable to pay for necessary repairs are faced with two main options: wait until they can pay or borrow the money they need. With household debt increasing annually and up by $1 trillion in 2021, many homeowners may already find themselves stretched to the limit. Only half of respondents (52%) could spare $100 in monthly repayments to finance a repair, and only two-thirds (66%) could afford a repayment as low as $50.

The cost of homeownership

Homeownership is rewarding, but it’s also costly and can be difficult to maintain. Only 8% of the homeowners we surveyed were able to say their home was currently issue-free. As we learned, it’s quite common for homeowners to save repairs for another day, and it’s not surprising that money is almost always the motivating factor — especially in the current economic climate.

It’s important to note that over two-thirds of those surveyed ended up having to pay more for a repair because they waited to address the issue. While home repair costs can be steep, prices seem likely to continue rising, so it’s best to handle home issues as soon as possible. If you fix something today and keep up with maintenance, you could be saving yourself cash for tomorrow — or, at the very least, giving yourself one less thing to worry about.

For homeowners facing repairs that seem out of reach, financing options like home equity loans and government-backed FHA 203(k) loans can help make them possible.

Methodology and limitations

For this analysis, we surveyed 1,078 homeowners. Of them, 575 were male, 498 were female and five identified as nonbinary. Our respondents ranged in age from 18 to 81 years old, with an average age of 39.

In some cases, questions and answers have been rephrased for clarity. To help ensure accurate responses, all respondents were required to identify and answer an attention-check question.

These results rely on self-reported data. Potential issues with self-reported data include but are not limited to selective memory, telescoping, exaggeration and other attribution errors.

Fair use statement

If you know a current or potential homeowner who might be interested in our findings, you’re more than welcome to share them. We just ask that you link back to this study and that you share our content for noncommercial purposes only.

You’re signed up

We’ll start sending you the news you need delivered straight to you. We value your privacy. Unsubscribe easily.