How to avoid the grandparent scam

Senior scams are on the rise, and our study shows which states have the highest risk

In a late 2019 report to Congress, the Federal Trade Commission (FTC) stated it counted 256,404 fraud complaints in 2018 from consumers who were at least 60 years old, accounting for nearly $400 million in losses.

One of the most frequent sources of complaints among seniors was imposter scams. Older U.S. residents often mentioned being targeted by the “grandparent scam,” in which a scammer contacts them and pretends to be the grandchild or a law enforcement officer or lawyer representing the grandchild. The scammer claims the grandchild is in trouble with the law and needs some quick cash.

Kathy Stokes, AARP’s director of fraud prevention programs, notes that this particular scam has been around for more than a decade, but it has been constantly refined and is even more dangerous now.

That’s partly because scammers have added a new COVID-19 wrinkle. Someone impersonating a senior’s grandson might say he suddenly developed coronavirus symptoms and had an accident on the way to the emergency room. He might claim that the other driver was seriously hurt and he doesn’t have his ID, so he pleads with his potential victim to wire him $3,000 and not tell his parents.

“And what’s the first thing you do as a grandparent?” Stokes asks. “You come to the aid of your grandchild, no matter what.”

Tapping into social media

Stokes says scammers have become more sophisticated, making them much more dangerous. In the past, a scammer had to hope his victim would say his grandchild’s name. Today, scammers sometimes already have that information.

“Scammers have begun to use social media to learn more about their victims,” Stokes told ConsumerAffairs. “On Facebook, they can easily see that Nancy has a grandson named Michael about the age of someone who might be living on their own for the first time.”

Scams have also become highly organized and are often run like businesses. While one scammer is on the phone with the victim, other team members are mining the internet for potentially helpful information to spring the trap.

In an informal survey of ConsumerAffairs readers, we learned that just over 30% of respondents had been contacted by a con artist pretending to be their grandchild or another family member in need of money. Nearly half — about 47% — said they knew someone who had been targeted by the scam. Fewer than 14% of respondents reported a financial loss as a result of the scam, however.

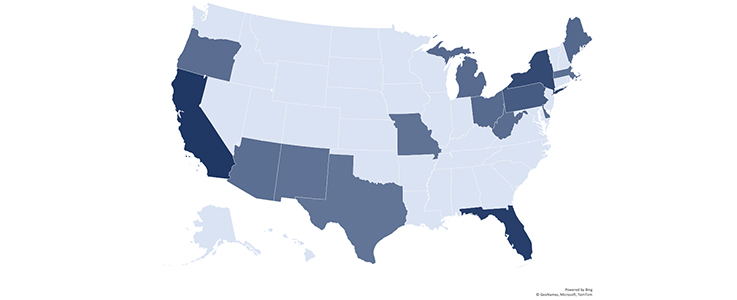

Top 15 states at highest risk of senior scams

ConsumerAffairs performed an analysis of survey responses, Population Reference Bureau (PRB) data and FTC data to assess the risk of these scams in each state. As you might expect, the most populated states are at higher risk of being targeted by scammers, followed by states with higher populations of people over the age of 65.

- California

- Florida

- New York

- Pennsylvania

- Maine

- Ohio

- Michigan

- West Virginia

- Oregon

- Arizona

- Delaware

- Massachusetts

- New Mexico

- Missouri

- Texas

Largest states lead the way in scam reports

The largest states reported the most contacts with this type of crime. Readers from California reported the most, followed by New York, Florida, Texas and Pennsylvania.

However, older residents in smaller metropolitan areas are still targeted. AARP’s Scam Tracking Map, which lets members report contacts with scammers, shows metro areas where the imposter/grandparent scam appears to be most widespread. Looking at reports from 2017 to 2020, we found a large number in cities like Albany, New York; Minneapolis, Minnesota; and Lansing, Michigan, suggesting that seniors in smaller cities can be disproportionately victimized.

How to protect grandparents

Imposter scams can, of course, strike anyone, anywhere. However, there are precautions families can take to protect grandparents.

One thing families with teenage or young adult children can do is devise a code word that can be used for communication between grandparents and grandchildren. If grandchildren ever need help, the grandparent should ask for the code word to verify the caller’s identity.

People should also make sure grandparents understand how common this scam is and that they could become targets. Red flags include the caller asking for money to be wired or to be transferred through the purchase of gift cards.

No matter what a scammer tells you, there is no legitimate reason to ever transfer money using gift cards.

All grandparents should also watch the video below, in which an interview with a former con man explains how he scammed seniors.

Stokes says the current COVID-19 pandemic adds to the risks. Scammers are experts at pushing our buttons, and their job is much easier these days.

Data and methodology

Our study aims to find the states where seniors are at risk of being contacted by these scammers. To determine our list, we looked at a recent ConsumerAffairs survey and data from the FTC and Population Reference Bureau (PRB). These three datasets take into account population, scam reporting and age.

The first factor we considered was the number of people who said they or someone they know had been contacted by an imposter scammer. In this ConsumerAffairs survey conducted via email, 282 of the 711 responses fit this criterion. This data was then narrowed by state and divided into a percentage. For example, California received 45 “Yes” responses, which were then divided by a total of 282 to get 15.96%.

The second factor we took into account was the PRB’s aging population data from an article written in 2019. Using Census Bureau data from 2018, PRB ranked cities by the percent of the population over 65 years old.

Finally, we considered the total number of scams reported to the FTC in 2017. According to another FTC article, about 13% of all scams are imposter scams, and a vast majority of imposter scams target the elderly.

Once these data points were gathered, we used a weighted average of the three indices to yield an overall risk ranking by state.

You’re signed up

We’ll start sending you the news you need delivered straight to you. We value your privacy. Unsubscribe easily.