LendingClub Reviews

Our promise. We provide a buying advantage with verified reviews and unbiased editorial research.

About LendingClub

With LendingClub, you can get a personal loan, refinance your car payments or take out a small business loan. Its online marketplace connects borrowers with a network of lenders to help them select the best loan.

Pros & Cons

Pros

- Quick, easy online application

- Fast money delivery

- No prepayment penalties

- Fixed interest rates

Cons

- Somewhat high minimum APR

Bottom Line

LendingClub is a lending marketplace that helps consumers get loans for various purposes. LendingClub also offers online banking. You can apply for one of its loan options or sign up for a bank account online.

Featured Reviews

I have borrowed from this lender twice and each time, it has been picture perfect. While no one wants to borrow to pay off debts, the fact that this company was willing to give me...

Read full reviewI was wary of getting a personal loan, I suspected there would be hidden fees or a hidden "extra" interest rate. As an attorney, I read the fine print carefully and found that the...

Read full reviewWhat is LendingClub?

LendingClub is an online marketplace that connects you with lenders. Its application process for personal or small business loans is quick and easy.

- Apply online by providing the amount you want to borrow and the purpose of the loan.

- Select a loan offer.

- Your money is deposited directly into your bank account within two days on average.

LendingClub offers multiple borrowing options, including personal loans, small business loans, auto refinancing loans and medical loans. LendingClub offers fixed interest rates and a single monthly payment. There’s also no penalty for paying off your loan early.

LendingClub loans

LendingClub has multiple types of loans available with different maximum loan amounts and terms. The right loan for you may vary based on how you intend to use the funds.

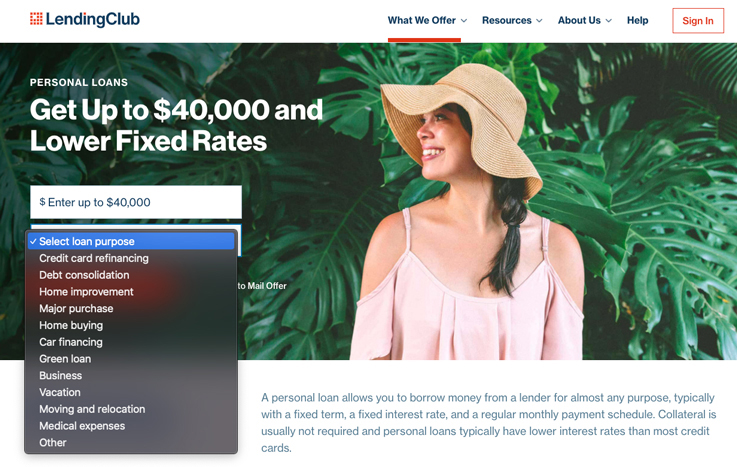

LendingClub personal loans

You can take out a personal loan of up to $40,000 for almost any significant expense, including:

- Paying off credit card debt

- Transferring a balance

- Consolidating debt

- Improving a home

Personal loan terms are 24 to 60 months, and all transactions take place through your LendingClub account. Once approved, your loan is usually deposited directly into your bank account within two days.

LendingClub business loans

With a small business loan from LendingClub, U.S.-based borrowers who have been in business for at least a year with $50,000 or more in annual sales can get up to $500,000 with a one- to five-year loan term. Small business loans have fixed monthly payments and no prepayment penalties.

LendingClub auto refinancing

The auto refinancing options are excellent for borrowers who owe $4,000 to $55,000 on their auto loan and want to lower their monthly car payments. Once you choose a refinancing offer, LendingClub pays off your previous lender. All payments go through a LendingClub account.

LendingClub Patient Solutions

LendingClub offers medical financing to help patients receive the care they need that may not be covered by insurance. LendingClub Patient Solutions include installment loans from $1,000 to $65,000 or revolving lines of credit from $499 to $32,000. Installment loans can be repaid in two to eight years with fixed rates ranging from 3.99% to 30.99%. Line of credit borrowers can secure rates as low as 0% APR.

LendingClub personal loan terms

Loan terms vary among lenders, and it's important to note the differences to find the best loan for you. We've highlighted some of the most important information about LendingClub's personal loans.

LendingClub personal loan terms at a glance

| Loan amounts | $1,000 to $40,000 |

| Term lengths | 24 to 60 months |

| APR range | 9.57% to 35.99% |

| Origination fee | 3% to 8% |

| Prepayment fee | None |

| Minimum credit score | 600 |

LendingClub rates

LendingClub charges an annual percentage rate (APR) between 9.57% to 35.99% on personal loans. Costs and fees for borrowing with LendingClub include an interest fee, and the company charges a one-time origination fee that's 3% to 8% of the entire amount you're borrowing.

LendingClub FAQ

How does LendingClub affect your credit?

Checking the rate you qualify for from LendingClub will not impact your credit score.

If you choose to move forward with the loan, LendingClub does a hard credit check to evaluate your creditworthiness, which may cause your credit score to drop temporarily.

How long does it take to get a loan from LendingClub?

You can get approved for a loan from LendingClub within 24 hours and receive funds within two days.

Does LendingClub verify income?

LendingClub verifies the incomes of most loan applicants. When applicants apply for loans, they go through a screening process that considers hundreds of data points that help identify which applications need further verification. Applicants may have to submit documents like W-2 forms, tax records or pay stubs for income verification purposes.

Can you pay off a LendingClub loan early?

LendingClub does not charge any penalties for paying off your loan early.

Is LendingClub legit?

LendingClub makes getting a loan quick and easy with its online application process and direct deposit, and there’s no penalty for paying off your loan early. Just be sure you’re getting a rate and loan term you can manage.

LendingClub Reviews

ConsumerAffairs has collected 373 reviews and 1,174 ratings.

A link has directed you to this review. Its location on this page may change next time you visit.

- 4,338,283 reviews on ConsumerAffairs are verified.

- We require contact information to ensure our reviewers are real.

- We use intelligent software that helps us maintain the integrity of reviews.

- Our moderators read all reviews to verify quality and helpfulness.

Reviewed Oct. 14, 2023

My experience with Lending Club was nice and the process was easy. I love how they send a reminder a week before the payment is due. They will make sure that the funds are there. You also couldn't beat the APR for what I got. The rep who helped me was very nice. The lady called me to let me know that the loan was approved and what account it would go to. Once they paid off the card that I needed to pay off, the difference would go into my bank account. She explained everything to me.

Thanks for subscribing.

You have successfully subscribed to our newsletter! Enjoy reading our tips and recommendations.

Reviewed Aug. 30, 2023

After looking at all the different options, LendingClub wound up being the best because of no fees. I took a debt consolidation. The application process was super simple. They didn't ask too much about income. They did a credit check. The credit minimum was somewhere in the 600s. It wasn't anything crazy. It was a really easy and good starter loan. Also, I was approved within 24 hours. It was really quick. I didn't have to wait at all. Working with LendingClub was good because I really needed it and it's helped ease a burden that was on me and it's really simple. I have autopay on, so I don't even have to think about it.

Reviewed April 20, 2023

I did a conventional loan through the internet, and the process with LendingClub was a lot easier. There was another company that didn’t have the fee at all, but their process of applying for a loan was way too lengthy. There were too many questions, and I didn't have too much time for that at the moment. If I had the time, I would have gone with them to avoid paying the fee. The process with LendingClub took a little longer than 24 hours, but they were all right, and if I had to do it all over again, I’ll give them a second chance. I have two loans and I would have to call them to find out if I could just put them together instead of having separate. Other than that, I'm satisfied so far.

Reviewed April 10, 2023

Trying to find a personal loan to help me consolidate my cc debt was extremely frustrating and stress inducing. So many preapproval messages getting you excited to get out of this hole but once you start the process that 10% apr preapproval for 13k turns out to be 28% for 4500…It felt like I was just going to have to let my credit get destroyed and just ride out having maxed out cards. Then comes LendingClub. Their preapproval process was legit, the rates were what they initially stated and the whole thing from start to finish was incredibly simple. The money was sent to my cc accounts in less than a week.

If I had one critique it would be that once you complete the application and sign into the site to check on the status of it you can easily submit another loan application without knowing it because it looks like you haven’t completed the app when you sign in. I got several emails saying my loan was denied because I already had an application active but I couldn’t find anywhere that stated it was processing or anything like that which would have been great. But that’s a small critique and overall I am extremely happy with everything LendingClub has done for me and I would highly recommend using them for a personal loan.

Reviewed April 5, 2023

LendingClub approved me and their interest rate and everything else worked way better for me. The application process was simple and easy. It took me more than 5 to 10 minutes, just because I had to look for some information. Everything was done online and the LendingClub website was easy to use. They didn't give me an issue and they didn't have me restart anything. I filled out the application and in a couple of seconds, I was approved. That worked out pretty well. The rates I got worked for me as well and it wasn't too high. This is my first time doing a personal loan and I had a good experience. LendingClub helped me, even though I didn't think I would be approved.

Reviewed Oct. 15, 2023

I got a consolidated loan from LendingClub. When I applied on the phone, it showed me that I was gonna pay a certain percentage for my loan, and then when I got all the paperwork and it was approved, and I signed it, I wasn't really happy with what I saw as far as the interest rate and how much percentage I was paying back. That was deception right there when it showed me one number before I got approved, and then when it came back and gave me my contract, that percentage was almost 7% difference. Over a three-year period, it would add about another 1,800 to my loan amount, which is what it did. I didn't think I was gonna pay almost a quarter of what I borrowed. That's called loan-sharking. They're helping people out, but do they really need to get money off of people who are already suffering out here?

I could have filed for bankruptcy, but that's not an option for me if I wanna keep my credit. So the other option was to consolidate, but to get that kind of amount coming back at me for 36 months left a very bad taste in my mouth. I'm happy I got approved, but I already knew I could have gotten approved somewhere else, and I was just in dire straits at the time.

Reviewed Oct. 11, 2023

I happened to be a customer of the bank for a few years. Eventually, I moved most of my funds out the bank due to lower interest rates. Lately, I've noticed that the bank has competitive CD interest rates and decided to open a 1yr CD. Strangely, you cannot open an additional account from your online dashboard and should apply as a new customer, regardless of your existing accounts (I have checking & savings accounts active). I set up substantial amount of money as ACH transfer from my other external account. In a few days of silence I contacted LendingClub bank to inquiry and learnt that my new account still under review. I asked the rep do not transfer my funds over weekend: each calendar day I'll lose $30+ in interest, including weekends.

The rep become aggravated and rude, I replied that if they move my money over weekend I'll cancel the new account application and move my business somewhere else. Immediately after the chat ended my online access to my accounts was blocked "due to recent activity". LendingClub bank has requested a copy of ID, a recent statement from my external bank and screenshot of my online dashboard of my other external account to be provided with to some Kiteworks.com, who I have no business with. Anyway, I complied and in 2 days I received email saying that "my accounts will be closed and in 15 business days" they'll mail a check of remaining balances.

BTW, I even don't remember how much money exactly I have with them and will not know because my online access is blocked, and they won't respond to my emails. Luckily, they didn't have a hold of my transfer, otherwise I would lost about $600+ in interest. The only reference I have is: Reference # **. This is my true story: no explanations, no remorse, nothing from the LendingClub Bank. Today, 22 days later - no check, no the account access, nada: as per CSR the account is "on hold". Think twice.

Reviewed Oct. 4, 2023

We made a double payment on our account by mistake. It took me calling 4 times throughout the day to get a manager. When I finally spoke to a manager, I was denied my refund because I “authorized it”. Even though it was a mistake, it is Oct 4, the payment was not due until the 21st. So I overpaid my account and was denied my refund. It was the worst service I’ve experienced in a long time and we’ve been recurrent customers since 2016!! Absolutely absurd, I even explained I’m now negative in my account and can’t afford to pay my electric bill or buy food.

Reviewed Oct. 1, 2023

LendingClub's process was pretty quick. I got the approval within a day or two, maybe less, and they approved me of whatever I was looking at. They had the best rates, too. The funding took a couple of days but it was straightforward and simple. The debt consolidation loan I got thru them has helped me do what I was trying to do.

Reviewed Sept. 21, 2023

LendingClub was easy to deal with. I did a personal loan with them and the application process was fairly simple. I did everything online and their website was very easy to navigate. The rates were good and fair. There was an initial rate that they had provided and when everything was finalized, it went to another rate. It wasn't much difference but it was different.

LendingClub Company Information

- Company Name:

- LendingClub

- Year Founded:

- 2006

- Address:

- 71 Stevenson Street, Suite 300

- City:

- San Francisco

- State/Province:

- CA

- Postal Code:

- 94105

- Country:

- United States

- Website:

- www.lendingclub.com