Best Life Insurance Companies

Use our guide to research and find the best life insurance company for you. We look at the types of policies available, the cost of life insurance and everything else you need to know to make an informed decision. These companies provide policies that ensure your family remains financially stable after your death.

- Our recommendations are based on what reviewers say.

- 4,337,775 reviews on ConsumerAffairs are verified.

- We require contact information to ensure our reviewers are real.

- We use intelligent software that helps us maintain the integrity of reviews.

- Our moderators read all reviews to verify quality and helpfulness.

Compare Top Life Insurance Reviews | ||||||

|---|---|---|---|---|---|---|

Compare

| Purchase term life insurance online and get coverage within minutes. No medical exam required. Policies are available in 10-, 15-, 20-, 25- or 30-year terms and start at $10 per month. | |||||

Compare

| Offers only term life insurance. Coverage up to $3 million available online. Prices start at around $10 a month. Backed and owned by MassMutual. Instant coverage up to $1 million available for healthy applicants under 59. |  | ||||

Term life and whole life policies with benefits up to $1.5 million. No medical exams or blood tests. Same-day coverage. Noncommissioned sales representatives. Policies for ages 20 to 85. Backed by top carriers. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Online life insurance company offering three life insurance options: traditional, no-exam and guaranteed. Independent broker. Simple application process. Provides benefit amounts between $50,000 and $5 million. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Compare

| Fully licensed and regulated digital insurance company. Provides 10-, 15-, 20-, 25- and 30-year term life insurance policies. Locks rates upon approval. No medical exam requirement. Rates start at $9 monthly. | |||||

Provides term and permanent life insurance policies to New York residents through in-home sales. Terminal illness rider available at no cost. Specializes in supporting and working with labor and credit unions. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers whole and term life insurance policies exclusively in Maine, Michigan, New Hampshire, Ohio and Vermont. Quotes available via local independent insurance agents. Provides an online life insurance calculator. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Offers term and whole life insurance policies in addition to auto insurance. Coverage terms up to 30 years for amounts up to and potentially exceeding $5 million. Quotes available online and through agents. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Independent affiliate of the Gerber baby food brand offering life insurance for children and adults. Grow-Up Plan protects children under 14 with a coverage policy they take ownership of when they turn 21. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Provides term, whole and universal life insurance policies. Online quotes and local agents available. Life Compass feature helps you find a policy. Issues coverage to adults up to the age of 75. Term coverage starts at $75,000. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Our favorite life insurance companies

With a significant decision like buying life insurance, it’s vital you have all the necessary information about the companies and their policies. We considered a wide range of factors when choosing the top 3 life insurance companies. When making your decision, you should always investigate:

- Stability of the company: Because life insurance is such an important and long-term decision, stability is the most crucial factor in choosing a company. We looked at ratings from AM Best, S&P 500 and Weiss and Moody’s. We also examined their review history and the overall financial history of the company.

- Policies offered: Five common life insurance types are term life, universal, whole life, variable life and survivorship life insurance. Having more options is generally better; however, focusing on just a few policies while optimizing those benefits could be more beneficial for some.

- Customer experience: We looked to see which life insurance companies had the best and easiest online experience. Reliable, readily available customer service was also a factor.

- Online tools: The best life insurance companies share as much information online as possible. These companies clarify your options and help illuminate the ins and outs of life insurance. Some online tools include insurance calculators, learning centers and online policy management.

Our favorite |

|

|

Policygenius is a life insurance aggregator, which means they look at deals on life insurance from a variety of providers and suggest the best one for your needs. Policygenius offers both term and whole life insurance. You do not have to pay a fee for using Policygenius. Instead, life insurance companies pay Policygenius for directing potential customers to them.

- What we like

- The process with Policygenius is simple: Take about five to ten minutes and enter your information in the online tool. This process will include basic questions, like family and personal health history. Policygenius will analyze your results and then direct you to the best life insurance option for you. We like that Policygenius is honest about the benefits and downsides of each insurance company. The site also has several educational resources if you’re still new to the topic of life insurance and would like to learn more.

- What to consider

- Although Policygenius has a good variety of providers, they can’t cover every provider out there. Keep in mind that there might be other options Policygenius doesn’t have listed.

- Who’s it good for

- Policygenius is good for those looking for either term or whole insurance options, with the biggest variety of companies and the easiest online experience.

Our favorite term life insurance company |

|

|

Haven Life is backed by MassMutual, one of the largest insurers in the United States. You can apply online for immediate coverage in about half an hour.

- What we like

- If you’re under 59 and are looking for $1 million or less in coverage, you may receive immediate inclusion. If you want an idea of what the price might be with Haven Life, you can obtain a free estimate of your rate on their website without having to provide any contact information. Haven Life also offers price comparison tools so you can see how their coverage options and prices compare to those of their competitors. Certain applicants do not have to go through with a medical exam. If you’re healthy and under the age of 45, you’ll probably be able to skip the medical exam and undergo speedy approval. If you do need a medical exam, you’ll have to take one within 90 days. You’ll still be given temporary coverage before you take the medical exam. Some pre-existing conditions, like diabetes, will not prevent you from receiving Haven Life insurance. Policies are available in the following lengths: 10 years, 15 years, 20 years or 30 years. Haven Life Plus is a free feature with loads of great benefits. With Haven Life Plus, you gain access to features like Trust & Will, Aaptiv, LifeSite and MinuteClinic.

- What to consider

- Haven Life does not offer whole life insurance. Whole life insurance covers you for the rest of your life. Instead, Haven Life offers term life insurance in lengths ranging from 10 to 30 years.

- Who’s it good for

- Haven Life is good for those looking for term insurance who want to deal directly with a life insurance company instead of through agents or another website.

Our favorite whole life insurance company |

|

|

TrustedChoice.com is not a life insurance website. Instead, they employ insurance agents to work on your behalf and find the best deal for you. It doesn’t cost any money to use TrustedChoice.com; rather, the company that ultimately offers you life insurance will pay TrustedChoice.com a fee for receiving you as a referral.

- What we like

- TrustedChoice has over 3,000 independent agents who work across the United States, maximizing your chances of finding life insurance that works for you. They also partner with over 60 life insurance companies, making it likely your agent will find a compatible life insurance policy. We like that the TrustedChoice website provides easy-to-understand information on the different types of life insurance. Their priority is to make sure you are informed about your choice, not to coerce you into a plan that may or may not work for you.

- What to consider

- Keep in mind that TrustedChoice is not responsible for the life insurance you choose. They might recommend a life insurance company, but the decision is yours. It’s essential to do your own research and confirm that the life insurance they offer is right for you.

- Who’s it good for

- TrustedChoice is good for those wanting to work with an independent agent to find the best life insurance option for them.

Types of life insurance

There are several policy options available. For more, read about how to know which type of life insurance is best for you.

Term life insurance

Term life insurance is a life insurance policy that lasts for a set period, or "term." Common life insurance terms are 5 years, 10 years, 20 years and 30 years. Term life insurance is typically the cheapest form of life insurance. That is because it doesn’t last as long as whole life insurance. Once the term has expired, the life insurance coverage ends.

Whole life insurance

Whole life insurance does just what it sounds like — it stays active for your “whole” life. As long as the policyholder pays the premiums, the life insurance will remain in effect. This sets it apart from term life insurance, which only lasts for a preset amount of time. Whole life insurance’s yearly cost is more than term life insurance’s cost. The most significant benefit of whole life insurance is that policy conditions, such as death benefits and specific payment information, are defined upfront. Whole life policies often build up a cash value which may be borrowed from or used to pay premiums. The premiums for whole life insurance are also typically set in advance and stay the same over the life of the policy.

Survivorship life insurance is a version of whole life insurance which can be purchased by couples. With this insurance in place, the benefits are paid out only after both parties pass away. You might also hear the term “permanent life insurance.” This is an umbrella term for life insurance policies that stay active until death. Permanent insurance includes both whole life insurance and universal life insurance, explained below.

Universal life insurance

Like whole life insurance, universal life insurance is permanent insurance that stays in force throughout your life. The main difference between universal life insurance and whole life insurance is universal life insurance has more flexibility with premium amounts benefits received on the payout. The terms change depending on how much the insurance company earns.

If the insurance company earns more than expected, a policy will build cash value quickly and might even result in reduced or eliminated premium payments. If earnings come in lower than expected, the policyholder may have to make up the difference by increasing premiums.

Variable universal life insurance

Variable universal life insurance is just like universal life insurance, except you can have multiple sub-accounts where the premium is invested. These sub-accounts operate similarly to a mutual fund. The “variable” in variable universal life insurance refers to the fact that investments will return variable amounts, either gaining or losing funds. The key takeaway is that variable universal life insurance provides the potential for higher returns, but it also exposes the investor to the risk of more significant losses.

Life insurance questions

What is life insurance?

Life insurance provides an agreed sum of money to your loved one in the case of your death. When you sign up for life insurance, you will designate a beneficiary, a term length for the insurance (which can include the rest of your life), and the amount of the payout. Life insurance can help provide stability to those who depend on your income.

How does life insurance work?

A life insurance policy requires you to pay a small monthly premium. If you die, the life insurance coverage will deliver a payout to your designated beneficiary. If you buy term life insurance, you will pay a premium for a set number of years, usually from 5 to 30. If you purchase whole life insurance, you will need to pay premiums for the rest of your life in order to receive a payout.

How much is life insurance?

Life insurance probably isn’t as expensive as you think. Several surveys have shown that Americans overestimate a given life insurance price by up to 200%. However, a 30-year-old woman purchasing a $250,000, 20-year term policy can expect to pay just $135 a year. A man of the same age with the same policy would pay about $150.

Life insurance cost varies based on your age, gender, health and lifestyle. After the age of 40, you can expect life insurance costs to increase by about 10% each year. Life insurance for women is often 15% to 40% cheaper than life insurance for men.

When should you get life insurance?

Technically, the best time to buy life insurance is the day you are born because life insurance gets more and more expensive as you go through life. If you’re worried about the cost, always remember that today is the youngest you’ll ever be. Fortunately, if you are over the age of 35, it’s not too late to buy life insurance. If you are 50 or over, you can still get life insurance, but the options will be limited, and it will cost more.

Is life insurance worth it?

Once you’ve asked, “What is life insurance?” the next question is, “Is life insurance worth it?” For many people, it is — especially if you have a dependent, spouse or relative who is heavily reliant on your income and support. Then, if you pass away, your loved one can be supported by the life insurance payout. No one likes preparing for their death, but it’s good to have a safety net for your loved ones in case something happens.

Is a whole life policy a good investment?

Thanks for subscribing.

You have successfully subscribed to our newsletter! Enjoy reading our tips and recommendations.

Life insurance reviews

Gerber Life Insurance is an affiliate of the Gerber baby food company, although the two are financially independent from one another. Gerber has been providing life insurance since 1967 with a focus on children and young parents. They currently sell policies throughout the U.S., Canada and Puerto Rico.

PolicyGenius is a website that allows you to comparison shop for various types of insurance. PolicyGenius’ life insurance options give you several quotes from leading life insurance providers, and you can apply directly from PolicyGenius.

TrustedChoice partners with independent agents across the United States to help consumers find competitive rates for their insurance needs. Their website offers a lot of helpful insurance advice in easily accessible language. In addition to life insurance, TrustedChoice can help consumers find an agent for their auto, home and business insurance.

AARP is a large organization boasting over 38 million members ages 50 and up. They opened their doors in 1958 and now have offices in all 50 states.

Prudential is a financial services conglomerate that first started operations in 1875. Headquartered in Newark, New Jersey, Prudential is and is a Fortune 500 company offering life insurance, annuities and investments to consumers.

Hancock was founded in 1862, but it was acquired by Canadian insurer Manulife Financial in 2004. The subsidiary is still headquartered in Boston.

Headquartered in New York City, MetLife, Inc. is the holding company for Metropolitan Life Insurance Company (Met Life). The parent company (MetLife, Inc.) is one of the largest insurance sales companies in the world — MetLife, Inc. has over 90 million customers in over 60 countries across the globe.

American General was founded in 1850. They do business with 13 million customers worldwide and offer a wide range of insurance products and annuities.

Also a Fortune 500 company, Mutual of Omaha was founded in 1909 and is based in Omaha, Nebraska.

The American Automobile Association has over 51 million members and the national headquarters are in Heathrow, Florida. AAA was founded in 1902.

Allstate was founded in 1931 as part of Sears, Roebuck and Company. Allstate established its beginning by selling auto insurance and calls Northfield Township, Illinois home.

As one of the only large insurance companies based on the West Coast, Farmers is headquartered in Los Angeles. Farmers opened its doors in 1928 but is now a wholly-owned subsidiary of Zurich Financial, an Irish insurance company.

New York Life offers life insurance, investment products, retirement income and long-term care solutions. It also provides services to assist with planning for retirement.

Founded in 1955, Aflac offers whole and term life insurance policies to individuals through their employers, with payment done by payroll deduction only. Aflac offers a variety of insurance policies that include life, auto and even cancer insurance.

American Family Life Insurance is a company that is dedicated to giving its customers peace of mind, as well as custom-tailored insurance policies that fit each individual's needs. They also make the insurance process simple by providing friendly and helpful service, as well as keeping the claims process easy and worry-free.

Erie Life Insurance is a Fortune 500 company that offers a variety of term, whole and universal life insurance solutions. It currently serves residents living in 12 surrounding states, along with those living in the Washington, DC, area.

Esurance Life Insurance is known for giving their customers an easy way to find insurance coverage online. They have grown into a company with over 3,000 associates nationwide that help people find the right policy to meet their individual needs. Their goal is to provide quality insurance coverage for the modern world.

USAA Life offers a variety of life insurance policies for active-duty, retired and discharged members of the military and their spouses, as well as a term life insurance plan for customers' children under the age of 17. Unlike other life insurance companies, USAA will pay benefits on a member's policy even if he or she is killed in war. Additionally, some USAA life insurance policies do not require a medical exam.

Farm Bureau Financial Services offers several types of life insurance to residents in Arizona, Iowa, Idaho, Kansas, Minnesota, Montana, North Dakota, Nebraska, New Mexico, Oklahoma, South Dakota, Utah, Wisconsin and Wyoming. They have earned "Excellent" ratings from A.M. Best for more than 50 years.

Founded in 1936 with a customer base of government and military employees, Geico has grown into one of the largest insurance companies in the US. Geico offers a range of insurance policies, which can be tailored to meet the needs of individual customers.

Globe Life Insurance is among the most prominent and reputable life insurance writers in the United States. Founded in Oklahoma in 1951, the company provides life and accident insurance to individuals. They offer a variety of plans that tailor to individual needs, and make the buying experience easy with no sales agents involved. They have more than $69 billion of insurance in force and are committed to providing secure life insurance protection to their policyholders.

Liberty Mutual provides Life, Home and Auto insurance that help meet the needs of individuals, families and businesses. Since 1912, Liberty Mutual has developed a corporate culture that treats its customers like people and strives to deliver excellent customer service.

For over 85 years, Nationwide Insurance has proven itself as a leader in the insurance industry. The company offers many choices with insurance — from auto and homeowners insurance to even life and pet insurance. Financial advisers can also help customers who may have concerns about their insurance needs.

Northwestern Mutual Life Insurance is a financial services company that provides its clients various insurance options and investment opportunities. It can aid individuals and businesses to possess a lifetime of financial stability.

Progressive Life Insurance helps individuals understand and compare different types of life insurance and choose policies that meet their needs. The company offers term, permanent and final expense life insurance, as well as a wide variety of riders, saving components and payment options. With an established quote system, a customer service telephone line and a wide range of policies, Progressive Life Insurance helps people plan for a secure future.

State Farm Life Insurance is a Fortune 500 company that specializes in a variety of insurance solutions, including term, whole and universal life insurance. Its flexible policy options allow its customers to obtain a customized life insurance policy that meets their needs and fits their budgets.

Author note

Expert grades are awarded based on the following criteria: availability of a wide variety of life insurance products, company focus on life insurance, and length of history offering life insurance products. We also take note of consumer reviews, when available.

The higher the grade, the more likely it is that the company will better compete for your life insurance needs. This is not to say that you should restrict your life insurance research to companies with higher grades or eliminate those companies with poor marks. Also, marks awarded here are no indication of financial strength and/or stability. Readers should perform their own due diligence prior to making any life insurance decision.

Life insurance is very situation-specific. Consumers should be absolutely sure about which type of life insurance they need before making a decision. A trusted advisor such as a tax planner, attorney, or financial planner should be consulted before purchasing a policy. There are a number of different types of life insurance policies, but each varies greatly in terms of cost and benefits. It’s critical to become familiar with these differences, so you have the best opportunity to choose the right life insurance provider and buy the policy that matches your unique needs.

Be cautious when asking insurance companies for advice because they may try to convince customers to buy products just for the sake of a sale. When you are certain about which type of life insurance you need, you should seek out multiple quotes. Remember life insurance agents who work as captive agents for one company can only sell that company’s products.

For women

Nearly everyone (85% of consumers) agrees that they need life insurance. Yet, only 62% of consumers say they have life insurance, and of those who do, more than 40% think they don’t have enough.

What’s more, there is a sizable gender gap in life insurance coverage. Only 40% of women in the U.S. have life insurance, and women average smaller amounts of individual life insurance coverage than men. On average, women have $129,800 of individual life insurance to men’s $187,100. Here are three reasons women, especially women with children, should own life insurance.

1. To protect their families from loss of income

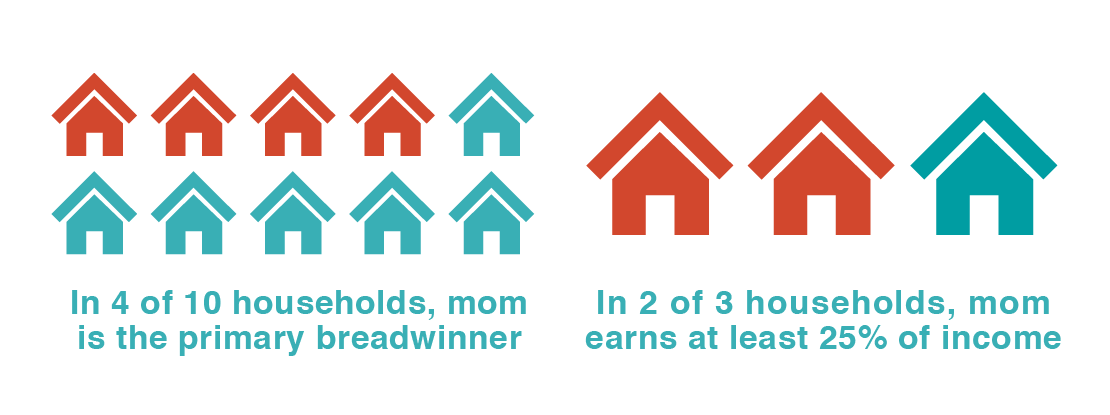

Most (70%) U.S. households with children under 18 would have trouble meeting everyday living expenses within a few months if a primary wage earner were to die. That could be bad news for the 40% of homes where mothers are the primary breadwinner in their family, and the more than 60% where the mother brings home at least 25% of the family’s earnings.

2. To replace the services they provide

In 2014, there were 5.2 million stay-at-home moms nationwide. And while no amount of money can replace the love and caring the moms provide their families, recent surveys show that stay-at-home moms would earn, conservatively, $117,000 per year for the tangible services they provide (activities like cooking, cleaning, and caring for their children). The same survey showed working moms render $71,860 per year worth of services on top of their annual salaries.

3. To care for their children

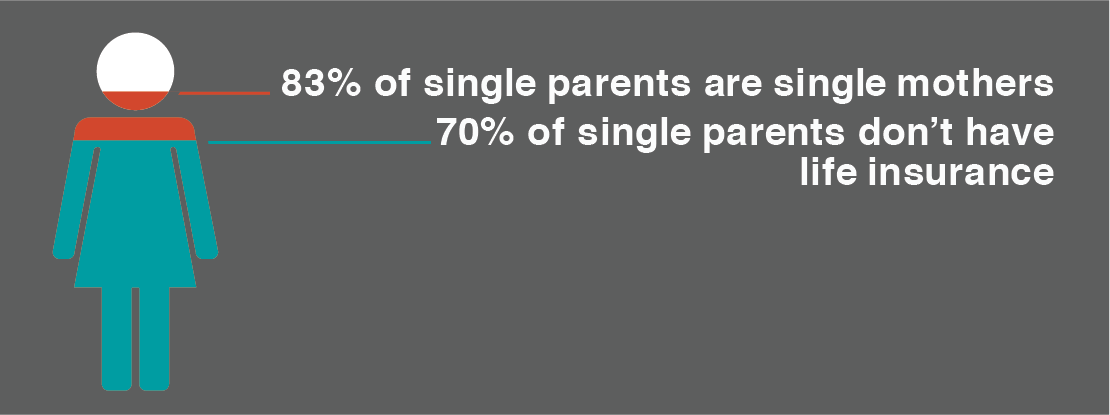

83% of single parents are single mothers. For them, life insurance will provide their children with the financial resources they will need to avoid additional hardships in their lives. Yet, 70% of single parents don’t have life insurance.

Although nobody wants to think about it, 800,000 people are widowed each year in the U.S. Life insurance gives moms peace of mind knowing that, should the worst happen, their families will be protected. For more helpful tips and user reviews to help you choose the right insurance provider for you, check out the rest of our guide.

Compare Top Life Insurance Reviews | ||||||

|---|---|---|---|---|---|---|

Offers term, whole, universal and variable life insurance policies. Optional long-term care coverage riders available. Provides term life quotes and life insurance applications online. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers group voluntary life insurance that includes a living benefit option, an accidental death and dismemberment rider and a disability waiver. Employee coverage up to $250,000. Quotes available through representatives. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term life, whole life and children’s life insurance policies with coverage up to $100,000 in some states. No medical or physical exam required. No waiting period. Rates start at $3.49 per month for adults. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Provides whole, term and universal life insurance, including whole life insurance policies for children. Lets you get a quote or apply for select policies online. Helps determine your life insurance needs online. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Provides term, whole and universal life insurance plans. Select coverage policies come with fixed premiums and limited flexibility in changing policy details and monthly payment amounts. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Offers two term life insurance policies for coverage of up to $5 million and terms of up to 35 years. No online quotes or pricing information. Applicants can be up to 70 years old. Maximum coverage age is 95. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term, universal and permanent life insurance plans starting at $16 per month. Also helps people with retirement and estate planning. Some policies require a medical exam. Online quotes not available. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Provides term life, group variable universal life, and accidental death and dismemberment insurance. Doesn’t offer life insurance policies for individuals (at the time of publishing). | Chat with a ConsumerAffairs decision guide Live agent | |||||

Life insurance coverage up to $50,000 with no medical questions, excluding the accidental death benefit rider. Take policy with you if you retire or change jobs. Provides quotes and a coverage calculator on the website. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Sells term and permanent life insurance. Offers the Aspire program for people with diabetes. Vitality program rewards healthy living with up to 15% in savings. Term coverage is available for up to 20 years and $65 million. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Provides permanent and term life insurance with nine optional riders. Covers people ages 18 to 64. No medical exams required. Monthly term rates typically $25 to $90. Whole life rates around $40 to $120. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term, whole and universal life insurance with up to $2 million in whole life coverage and up to $10 million in term life coverage. Adults up to 80 years old can apply. Term policies typically cost $31 to $177 per month. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers life insurance for AARP members through New York Life. Term and permanent group coverages available. No medical exam required. Coverage varies up to $100,000 for adults up to the age of 80. Rates fixed for select policies. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Term and permanent life insurance available. Choose policy terms between 10 and 30 years. Provides free medical exams, a 30-day money-back guarantee and flexible payments. Sample monthly rates range from $24.64 to $310.41. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Provides term, universal and guaranteed-issue whole life insurance policies. Online policy management available. Guaranteed acceptance for whole life insurance policies for applicants 50 to 80 years old with no medical exam. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term life insurance directly and issues a multitude of insurance products through partnered brands, including AIG. Online quotes and policy management available. Issues policies in New York through a partner company. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Provides quotes in less than a minute. Offers permanent and 10-, 15-, 20- or 30-year term life insurance policies. Buy insurance online if you qualify. Features a calculator to help you estimate your life insurance needs. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers permanent and term life insurance policies. Provides local support services along with 24/7 telephone support. Not available in Massachusetts. Term life rates start at $15.02 per month for a 10-year term. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Helps you compare life insurance quotes from 13 different providers in minutes. Lets you choose from multiple offers. Doesn’t charge additional fees for its services. Apply directly on the website. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers death benefit protection with four types of annuity products and two types of life insurance. Hybrid policy option available. Prices vary based on factors like age, health and selected coverage. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term and whole life insurance policies. Gives rate reductions of up to 25% for new term life insurance policies. Get a quote and apply online. Whole life insurance coverage can exceed $1 million. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers a variety of supplemental health, group and special risk insurance policies. Doesn’t offer all its products in every state or provide online quotes. U.S.-based customer service. Family-operated for over 80 years. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Insures members of the military and their families. Offers term and permanent life insurance policies with the option to update your policy over time. Online quotes available. Life insurance rates start as low as $12 per month. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers life insurance and other products through its three subsidiary insurance companies: Bankers Life, Colonial Penn and Washington National. Subsidiaries have more than 3.2 million policies total. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Partners with Life Quotes Inc. to offer term, whole and universal life insurance policies. Medical interview required for coverage over $250,000. Get a free quote online or by phone. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term and whole life insurance policies, plus two types of annuities. Guarantees level premiums. Customizable riders and add-on benefits available. Provides life insurance quotes online or by phone. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Matches you with independent agents for term and permanent life insurance policies. Works with over 250,000 qualified agents in the U.S. to evaluate options from up to 45 insurers. Apply in as little as two minutes. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term, whole and universal life insurance with coverage ranging from $5,000 to $1 million. Burial insurance also available. Helps you get and compare quotes online. Rates start as low as $14 per month. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers six life insurance policies, including term, whole, children’s, senior and DreamSecure Flexible insurance. Doesn’t always require a medical exam. Provides a discount for bundling life and car insurance. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers term, whole, universal and indexed universal life insurance. Provides a life insurance coverage calculator on its website. Contact an agent for a quote. Agents available in just six states. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Offers term, whole, universal and ERIExpress life insurance policies in just 12 states and Washington, D.C. Quotes and a coverage calculator available online. Get $250,000 of coverage for as little as $14.24 per month. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

No longer offers life insurance. Provides car, motorcycle, homeowners and renters insurance policies. Free online quotes within an average of six minutes. An Allstate company. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Offers life insurance and complimentary will creation. Provides free online quotes and applications. Adjustable term lengths and coverage options. Financial organizational tools for families. Not available in all states. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Term-life insurance company. Not available in all states. Annual income protection up to $500,000 per year/$10 million per plan. Must be between 18 and 50. Must be a U.S. citizen or permanent resident. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Life insurance policies. Permanent and term life insurance. Accidental death coverage. Final expenses coverage. Life insurance riders. Online life insurance calculator. Same-day approval and coverage. | Chat with a ConsumerAffairs decision guide Live agent | |||||

Offers term life insurance coverage online. Decrease or increase your coverage as often as you need. Cancel at any time. No cancellation or alteration fees. Provides a price-lock guarantee and online applications. |  | Chat with a ConsumerAffairs decision guide Live agent | ||||

Information in this guide is general in nature and is intended for informational purposes only; it is not legal, health, investment or tax advice. ConsumerAffairs.com makes no representation as to the accuracy of the information provided and assumes no liability for any damages or loss arising from its use.

Want your company to be on this guide?

Yes, continueYou’re signed up

We’ll start sending you the news you need delivered straight to you. We value your privacy. Unsubscribe easily.