Our promise. We provide a buying advantage with verified reviews and unbiased editorial research.

About Newrez

This profile has not been claimed by the company. See reviews below to learn more or submit your own review.

Newrez (NMLS #3013) is a mortgage lender that originates conventional and government-backed loans, including VA and FHA loans. In 2022, Newrez, doing business as Shellpoint Mortgage Servicing, agreed to a $500,000 settlement in a class-action lawsuit regarding misleading mortgage statements.

Pros & Cons

Pros

- Licensed in all 50 states

- Online application process

- Smartphone app available

- 40-year non-qualified loan option

Cons

- Does not publish starting rates

- Above-average rates in recent years

- Pre-qualification tool may not produce a rate quote

Bottom Line

Newrez is a nonbank lender that promises a simple online application process. However, some customers may find obtaining a custom rate quote more difficult than expected. If you have trouble meeting traditional loan requirements, you may also be interested in its 40-year non-qualified loans.

Rates

Newrez does not publish its current rates, but Home Mortgage Disclosure Act data shows its average rates for home purchase loans were slightly higher than the national average from 2019 to 2021. To see what rate Newrez would offer you, you’ll need to complete its pre-qualification process.

Newrez average home purchase rate vs. national average

| Year | Difference from national average |

|---|---|

| 2021 | +0.04% |

| 2020 | +0.11% |

| 2019 | +0.25% |

Newrez offers both fixed- and adjustable-rate loans. An adjustable-rate mortgage (ARM) has a fixed rate for a set period of time, and then it periodically adjusts through the remainder of the loan term. When it resets, it changes in accordance with a benchmark interest rate; so, if the benchmark interest rate is higher than the ARM’s initial rate, the monthly payments should go up.

Most borrowers like the predictable payments and security of a fixed-rate loan. But there are times when an adjustable loan makes sense. If you plan to refinance the loan or sell your home before the introductory period is over, you may save money with an ARM. Your loan officer can help you find the right loan for your short- and long-term goals.

Application process

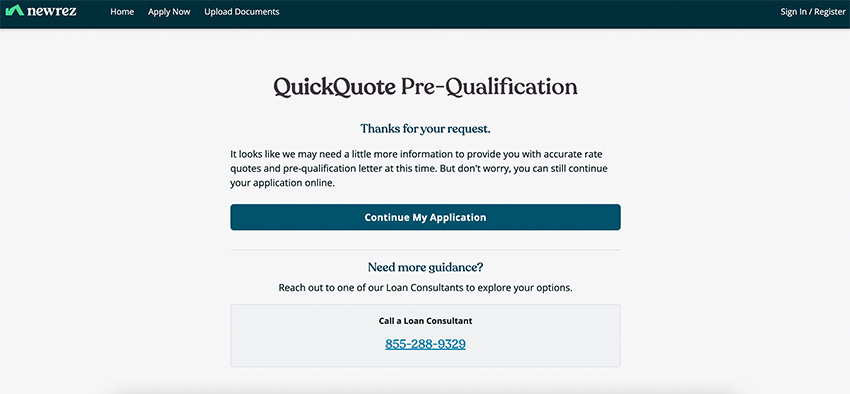

Newrez’s QuickQuote pre-qualification only takes about five minutes. It asks a few very general questions about your estimated purchase price, down payment amount and some other personal details.

However, the QuickQuote name is a bit misleading — completing the form isn't necessarily enough to get a quote. Once you’re done, you may be asked to move on to the next step in the application process or to reach out to a loan consultant for a quote.

The next step in the Newrez mortgage application is to create an account and begin submitting documents to the portal. You will also be able to check the status of your loan application and access key information here.

Newrez application features

| Features | Availability |

|---|---|

| Online application | |

| Mobile document upload | |

| Physical branches | Undisclosed |

| Publishes minimum rate on website | X |

| Rate lock | Undisclosed |

| Pre-qualification (no hard credit pull) | |

| Certified approval letter |

Loan types

Newrez offers conventional loans (with both fixed and adjustable rates) and government-backed loans (including FHA loans and VA loans). However, it doesn’t offer jumbo loans or USDA loans.

In 2021, it closed 15,904 loans out of 22,771 applications (about 70%), and its denial rate was in line with the national average (around 8%).

Loan applications for home purchases only by year

| 2021 | 2020 | 2019 | |

|---|---|---|---|

| Home purchase applications | 22,771 | 15,041 | 16,880 |

| Home purchase loans closed | 15,904 | 9,498 | 11,095 |

| Home purchase applications denied | 1,859 | 1,868 | 1,275 |

| Home purchase preapprovals denied | 0 | 0 | 0 |

In September 2022, Newrez also introduced a 40-year non-qualified mortgage that offers a fixed rate and interest-only payments for the first 10 years before adjusting to a 30-year, fixed-rate loan with monthly interest and principal payments. This type of loan is designed for borrowers who may have trouble getting traditional loans.

Refinancing

Even before rates hit historic lows in 2020 and 2021, about 68% of all Newrez’s closed loans were refinances. In 2021, though, refinancing accounted for roughly 88% of its closed loans, reflecting an industry-wide trend. Nearly all lenders saw consumer demand for refinancing spike in this period as low interest rates spurred borrowers to try to lock in lower rates and save money.

That trend is not likely to continue, though. Mortgage rates rose throughout most of 2022, so fewer borrowers are expected to refinance. Refinancing can still be worthwhile if you can lower your interest rate by 1% or more, but be sure to take closing costs into account when you weigh your options.

Home purchase vs. refinance loans by year

| 2021 | 2020 | 2019 | |

|---|---|---|---|

| Home purchase loans | 11.61% | 11.18% | 31.73% |

| Refinance loans | 61.39% | 69.62% | 38.40% |

| Cash-out refinance | 26.69% | 19.01% | 29.63% |

Requirements

Newrez doesn’t publish all of its requirements for borrowers, but we’ve collected what’s available and included some general information below to help you set your expectations.

Newrez requires you to have a credit score of 580 or higher for an FHA loan. For a VA loan, you need to have a score of 600 or higher to avoid making a down payment. If you can make a 5% down payment, the credit score requirement drops to 560, though.

Newrez doesn’t specify its requirements for conventional loans, but you typically need a credit score of at least 620 and a down payment of at least 3%. (Most down payments on conventional loans are higher.)

National mortgage requirements by type

| Min. credit score | Min. down payment | Compare with other lenders | |

|---|---|---|---|

| Conventional | Typically 620 | Typically 3% | Mortgage lenders |

| FHA | 500 | 3.5% with 580 credit score | FHA lenders |

| VA | Set by lender (often 580) | 0% | VA lenders |

For other loan types, read our guides on jumbo loans, home equity loans, HELOCs and USDA loans.

Costs and fees

Newrez publishes a partial list of its fees, which is more than most lenders offer but not enough to accurately predict your closing costs ahead of time. In total, closing costs for a home purchase generally equal 2% to 5% of the loan amount. Closing costs may include lender fees, appraisal fees, real estate taxes, attorney fees and mortgage insurance premiums.

You won’t have to pick a lender with no information, though. After your application has been received, you’ll get a Loan Estimate that itemizes what your closing costs should be. You’ll also get a Closing Disclosure later on with the final totals for your costs and fees.

FAQ

What is Newrez?

Newrez is a nonbank mortgage lender that is licensed nationwide. It offers conventional and government-backed loan products, and you can use the Newrez app to upload documents and keep up with your loan’s progress.

Is Newrez legit?

Newrez is an operating company of Rithm Capital (formerly New Residential Investment Corp.). Newrez has been in business since 2008, and it originated $97.6 billion in loans in 2021.

In 2022, Newrez, doing business as Shellpoint Mortgage Servicing, agreed to a $500,000 settlement in a class-action lawsuit over misleading mortgage statements, though it did not admit wrongdoing.

Where is Newrez available?

Newrez is licensed in all 50 states, Washington, D.C., and several U.S. territories.

Newrez Reviews

A link has directed you to this review. Its location on this page may change next time you visit.

- 4,338,283 reviews on ConsumerAffairs are verified.

- We require contact information to ensure our reviewers are real.

- We use intelligent software that helps us maintain the integrity of reviews.

- Our moderators read all reviews to verify quality and helpfulness.

Reviewed Aug. 23, 2023

I began a refi with NewRez/PHH, my current mortgage company. After 4 long months, cost of appraisal - $600., repair to house trim- $1200; extension to hot water tank - $300; paid additional bills to prove they were up to date - $600.00 we finally satisfied the appraisal demands with underwriter. (never heard to this) but ok onward. We are now with paperwork and income verification which was a lot of repeated proof after 1 month. 3 months of bank statements, tax forms, check stubs, retirement award letters and more tax forms. They come back and say show us proof that you paid your last bill even though they could see it on the bank statements. This went on for another month. Our credit score is at a 670, but because it is low we need more proof. What? Why? How? Ok we continue to provide proof and get the news that government loans are strict and will not approve with 1 late in 12 months.

I explained this was a bank error, bank sent an apology accepting responsibility, but not NewRez/PHH. They changed it over to a conventional loan and here go another 2 months and start all over. I have not heard back from them since the start of conventional loan started. This was 7 days ago. Out of money, and deeper in debt than we started. DO NOT USE THIS COMPANY.

Reviewed June 7, 2023

As you can see by the vast majority of reviews, this is an extremely horrible company. If you can refinance with another company, it will definitely be worth it. The CSR's at this company are complete idiots and do not care one bit about customer service, as do their "supervisors". They say the lines are recorded, but by the way they all talk to customers, I would say that is an outright lie.

It extremely difficult to self service your loan, and when you call in, you would have an easier time getting the code for the vault at Fort Knox. They make it as difficult as possible to go through the process of verification, and you have to say the same things multiple times. There is no consistency among CSR's and you will get a different story from each and every one of them that you talk to. They will outright lie to you and call you a liar when you call them out on it. By all means possible, try to go with another company if your mortgage gets sold to these ridiculous people. The extra money it costs will definitely be worth not having the headache of dealing with this company.

Thanks for subscribing.

You have successfully subscribed to our newsletter! Enjoy reading our tips and recommendations.

Reviewed Oct. 20, 2022

I was assigned to this company when I refinanced my mortgage in January of 2022. In the time since I have had no problems of any kind. I do my business with them strictly online so I have never reached out to them and can't comment on their customer service.

Sources

- Federal Financial Institutions Examination Council, “ HMDA Data Publication .” Accessed July 6, 2022.

- Top Class Actions, “ Shellpoint Mortgage Servicing misleading statements $500K class action lawsuit settlement .” Accessed September 28, 2022.

- HousingWire, “ NewRez debuts 40-year non-QM mortgage product. .” Accessed September 28, 2022.

Newrez Company Information

- Company Name:

- Newrez

- Website:

- www.newrez.com

You’re signed up

We’ll start sending you the news you need delivered straight to you. We value your privacy. Unsubscribe easily.