78% of pet owners would consider going into “pet debt”

A study by the American Veterinarian Medical Association found that around 80% of pet owners consider their pets to be family members. But does that mean they are willing to spend more money on them? We surveyed ConsumerAffairs readers via SurveyMonkey about their pet spending habits, from food to grooming to medical care, and found that 78% of respondents would consider going into debt for their pet, especially for a medical emergency.

Key findings

- 50% of respondents would use a credit card to pay for a pet’s medical crisis.

- Millennials were the most likely to take on debt for their pet.

- 22% of respondents were willing to spend $5,000 or more for a pet emergency.

Four in 10 pet owners would go into debt, another third would consider it

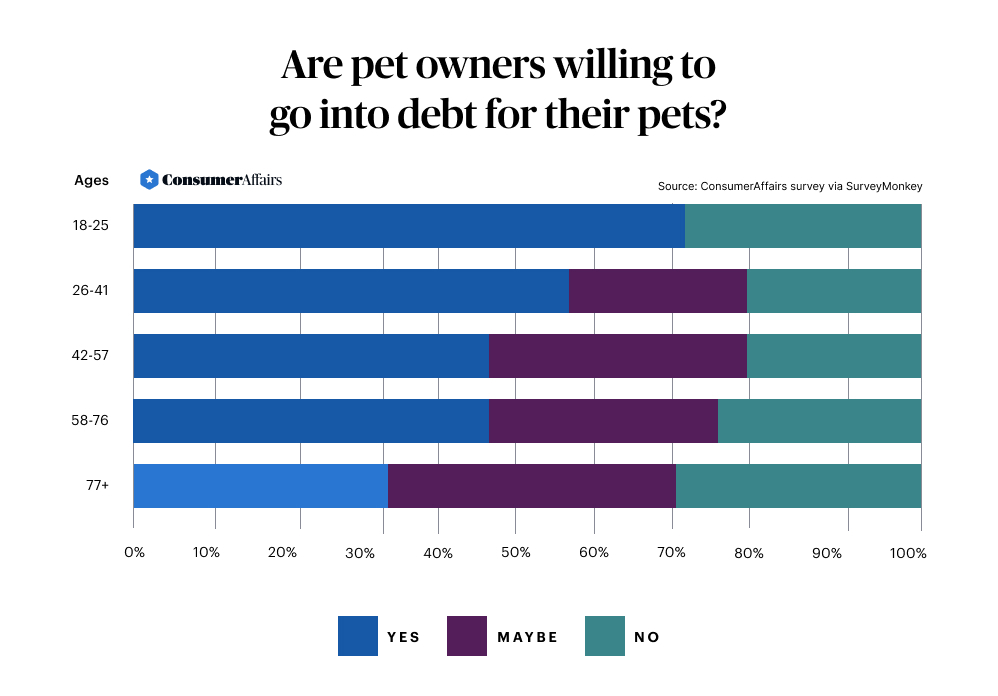

When it comes to a pet emergency, almost half (43%) of respondents said yes, they would go into debt for their pets, while another 35% said they might.

Baby boomers and Gen Xers were almost equally willing to take on debt for their pets. Millennials were the most likely to go into debt, with 51% of respondents ages 26 to 41 saying yes, and an additional 26% saying they maybe would.

Millennials make up the highest percentage (32%) of pet owners in the United States, according to the 2021-2022 Animal Pet Products Association (APPA) National Pet Owners Survey. They were followed closely by baby boomers (27%) and Gen Xers (24%).

Vet and medical costs are the second-biggest pet expense

Emergency pet visits can be unpredictable, and the costs can add up quickly. Dr. Rebecca Greenstein, a veterinary medical advisor for Rover, shares that an ER visit for a simple eye infection would cost up to $200, so expect the starting costs of a visit for other emergencies to range between $300 and $400. “There are a number of factors that go into the price of emergency veterinary care: the urgency and severity of the illness or injury, the extent of investigation needed, the intensity of treatments required, and whether a case is medical or surgical, to name a few,” she said.

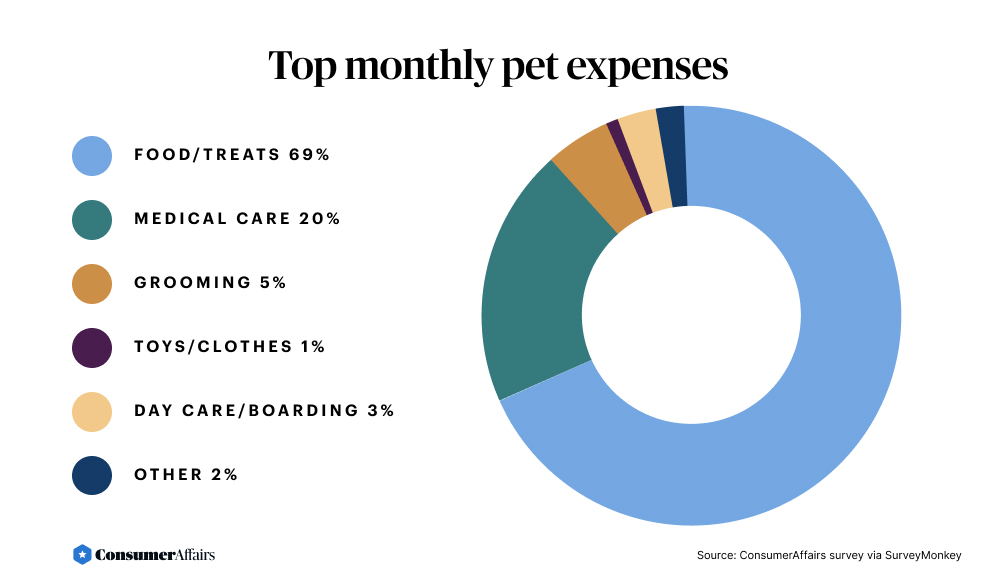

Behind pet food and treats, one-fifth (20%) of owners surveyed said that their biggest monthly expense was medical costs for their animals. These costs could include preventive vet visits and vitamins, as well as emergency pet care and prescriptions. According to the APPA survey, pet owners spend an average of $178 to $242 for routine vet visits and $201 to $458 on surgical visits.

APPA states U.S. pet owners spent $34.3 billion on veterinary care and products in 2021.

50% would use a credit card to pay for a pet emergency

When faced with a big payment for a pet emergency, 57% stated they would use their emergency fund or savings. However, those funds can be quickly depleted.

“We had one of our dogs hit by a car in January, and she had to have surgery on both of her front legs,” one respondent from Texas reported. “It cost us over $6,000. We had money saved to do repairs on the new home we purchased, and we used that to save her life.” They went on to explain that another time their dog had to have emergency surgery during labor complications.

“I had to clean out my savings and used my credit card to pay for our other bills,” they told us.

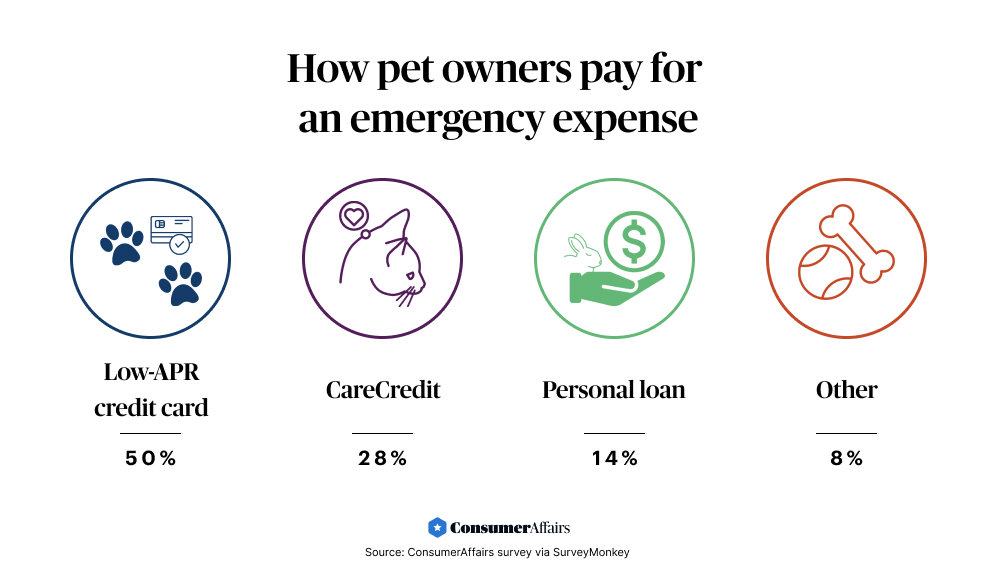

Even those respondents with an emergency fund would be willing to go into debt for their pets if their savings didn’t cover the full cost of the emergency. In fact, 50% of respondents said they would use a low-APR credit card to pay for a medical emergency for their pets.

An additional 28% would use CareCredit, a special line of credit reserved for medical expenses that often comes with no-interest periods, and 14% would take out a personal loan.

If you choose a credit card or loan, pay attention to interest rates. High rates can make a steep vet visit even costlier.

22% of pet owners would pay over $5,000 to save their pets

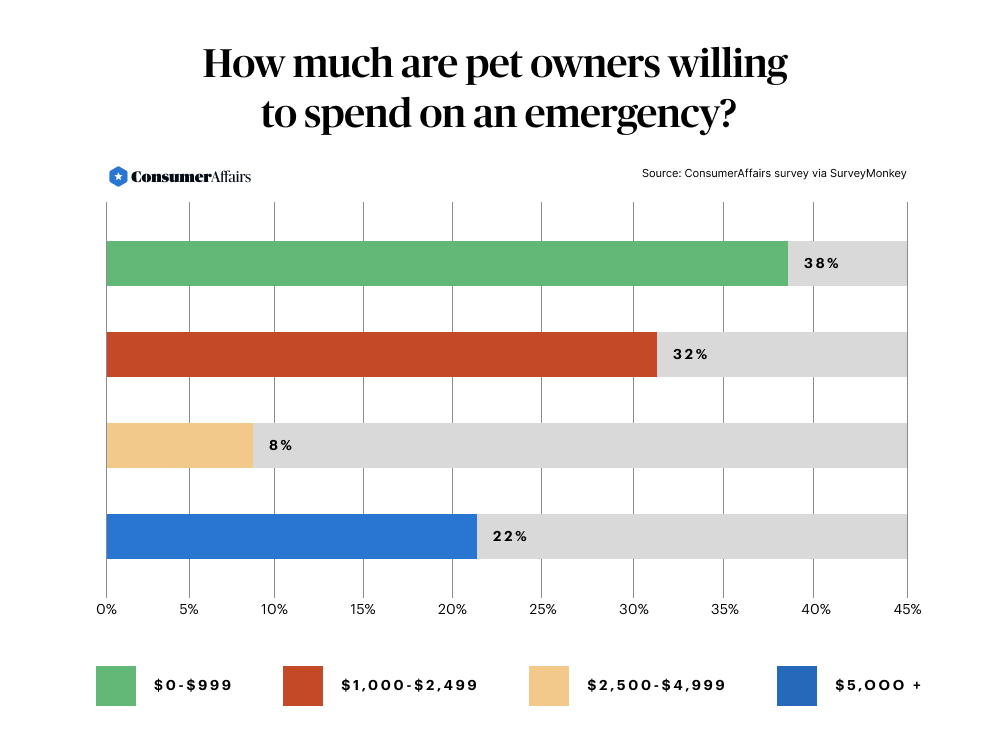

While many pet owners are willing to take on debt for their pets, the financial threshold that guides their decisions varies. A little over a third (38%) said they were willing to spend $0 to $999 on a pet emergency, and 32% said they would spend $1,000 to $2,499. An additional 22% would spend over $5,000 – with 32% of those respondents reporting they would pay “whatever it takes.”

One respondent, a dog owner from Vermont, lost a 12-year-old dog to a fatal accident. Had the injury been treatable, the pet owner recalled, “I would not have had debt options nor did I have the ability to pay off that debt had I incurred any. I would have felt like crap if there was a treatment that would have saved him and I didn't have money to get it for him.”

Vets caution that some of those lower thresholds may be unrealistic and that pet owners are often pushed beyond them by circumstances. “I find that pet owners consistently underestimate the cost of veterinary care, especially in unexpected emergency situations,” said Dr. Greenstein.

She encourages pet owners to save for such scenarios. “I would urge pet parents to take a proactive approach and plan ahead,” she advised.“If bloodwork or X-rays are deemed necessary, these bills can quickly top $1,000, which can leave many pet owners completely overwhelmed.”

It might be hard to figure out how much to save. A good place to start is by researching the average costs of some common emergencies and budgeting for those in cash. If you already have pet insurance in place, start by saving the amount of your deductible or co-pay. Any cash set aside can help.

How to afford a petmergency

No pet parent should have to make the choice between their beloved animal and their financial stability. Ideally, you should start planning your budget for a pet emergency before it happens – either through an emergency savings account or getting pet insurance when your pet is still young and healthy.

However, when you are in the thick of a medical crisis, or pet insurance isn’t an option, here are some options for affording a pet emergency:

- Ask your vet for payment options: Before you hand over a credit card, ask your vet what payment options are available. They might work with you on a payment plan, breaking your bill into manageable monthly payments without charging interest.

- Consider CareCredit: Some vets accept CareCredit. For many new accounts, promotional financing is available. This will allow you to defer interest charges for a set amount of time. As with a credit card or personal loan, approval is based on your creditworthiness.

- Apply for a low-interest credit card: Resist the temptation to swipe whatever plastic you have in your wallet to cover your pet costs. If your credit score is good, a low-interest credit card, especially one with a promotional 0% annual percentage rate (APR), can save you a lot of money.

- Take out a personal loan: A personal loan might come with a higher APR than a low-interest credit card, but the fixed term and monthly payments make it easier to know when your debt will be repaid.

- Crowdfund: An alternative to taking out debt is to ask your family and friends for help. You can ask them directly or set up a crowdfunding page explaining your situation. Expect many platforms to take up to 8% in fees for any money you raise.

Some of these funding options will rely on your creditworthiness, and not all applicants will be eligible for low-interest credit cards or personal loans. Know your credit score before applying for a new line of debt.

Bottom line: Find the balance between your pet’s medical care and your finances

There is no right or wrong answer when it comes to taking on debt for a pet; it’s a personal decision, and how much you spend is up to you.

“Pet owners should never have to sacrifice necessary medical care for financial reasons,” Dr. Greenstein said.

Although no amount of money can guarantee your pet’s life will be saved, you may determine that spending a large amount is worth it, especially if your pet is young and the post-emergency prognosis looks good.

Unfortunately, even if you spend thousands of dollars, there is always a risk that your pet won’t survive. One North Carolina reader said: “My previous dog was diagnosed with inflammatory bowel disease. … I spent over $10,000 trying to save his life, to no avail. Had to let him go two and a half months later … very financially distressing and heartbreaking.”

Preparing financially for the worst-case scenario with pet insurance or a dedicated pet savings account can make these stressful pet situations more manageable. Although you want to do anything for your pet, you shouldn’t have to choose between financial stability and emergency medical treatment.

If you do need to take on pet debt, choose low-interest lines of credit, work out a payment plan with your vet, take out a personal loan or consider crowdfunding.

Methodology

For this story, we used data from several sources: results from a SurveyMonkey survey sent to ConsumerAffairs email subscribers, interviews with veterinarians and publicly available national data.

To gather survey data, we conducted an online survey through SurveyMonkey to poll ConsumerAffairs email subscribers on their pet spending habits. The survey was open from Oct. 25, 2022 through Nov. 6, 2022. We received 434 unique responses.

The survey was sent to residents of all 50 U.S. states and Washington, D.C. Almost one-third (30%) of respondents live in California, Florida or Texas. No responses were provided from residents of Maine, South Dakota, Rhode Island, West Virginia, Wyoming or Washington, D.C.

For the purposes of our survey, generations are defined as follows:

- Gen Zers are 18 to 25.

- Millennials are 26 to 41.

- Gen Xers are 42 to 57.

- Baby boomers are 58 to 76.

- Silent Generation respondents are 77 and older.

Over half of responses (55%) were from baby boomers, while GenZ and Millennials made up only 9% of respondents.

To gather additional data, we interviewed licensed veterinarians, asking for their opinions and knowledge on pet emergency spending. We also researched and compared our findings with national pet spending data and trends.

Article sources

- American Pet Products Association, “ Pet Industry Market Size, Trends & Ownership Statistics .” Accessed Nov. 13, 2022.

- American Veterinary Medical Association, “ Pet ownership stable, veterinary care variable .” Accessed Nov. 13, 2022.

You’re signed up

We’ll start sending you the news you need delivered straight to you. We value your privacy. Unsubscribe easily.