What is a good credit score?

Find out what makes someone creditworthy

The term "good credit score" gets thrown around quite a bit, but what exactly does it mean, and why is it important? Simply put, your credit score is a reflection of your creditworthiness and financial history. It's a three-digit number that lenders use to determine how risky it would be to lend you money or offer you credit.

A good credit score can open the door to many financial opportunities, from mortgage approval to low-interest rewards credit cards. Having a bad credit score can disqualify you from financing and even affect your ability to rent an apartment.

Whether you're just starting to build credit or trying to improve your score, we will help you understand what a good credit score is and how to get it.

Key insights

- Your credit score can affect everything from your ability to get approved for a loan to the interest rates you're offered.

- Lenders also consider other factors, such as your income, employment history and debt-to-income (DTI) ratio, when making lending decisions.

- Closing credit accounts can hurt your score because it can impact your credit utilization ratio and reduce the length of your credit history.

What credit score is considered good?

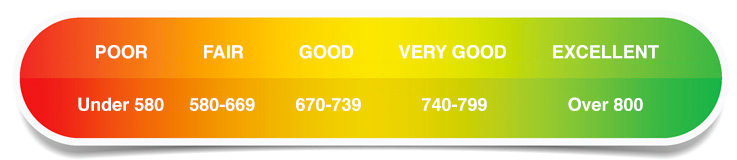

Credit scores range from 300 to 850, with 850 being “perfect.” Each creditor has its own benchmarks for a good or excellent score, but in general, an excellent credit score is any number above 800, while a good or very good credit score is between 670 and 799.

Companies use credit scores to determine the likelihood that a borrower will repay a loan, with a higher credit score suggesting you’re more “creditworthy.” How credit scores are evaluated can depend on the situation. For example, typically a homebuyer will need a higher credit score than someone who is applying for a small personal loan or credit card.

According to Leslie Tayne, a financial attorney at Tayne Law Group in Melville, New York, “A good credit score for someone wanting to take out a personal loan depends on the lender's specific requirements. Generally, a credit score of 670 or higher is considered good and may qualify you for favorable loan terms, including a lower interest rate.”

In general, people with lower credit scores can expect higher interest rates and more challenging approvals. It’s important to check your credit score by requesting your credit reports at least once a year.

» MORE: How to check your credit score

What makes a good credit score?

FICO and VantageScore look at various factors in calculating credit scores, assigning different weights to each category. For example, FICO places the most weight on payment history and amounts owed, while VantageScore places more emphasis on the age of credit accounts.

Payment history

This is the most important factor in your credit score. It measures whether you've made payments on time for your credit accounts, such as loans and credit cards. Missing a payment can drop your credit score significantly.

Credit utilization

This measures the amount of credit you're using relative to your available credit. It’s calculated by dividing the total amount of debt you have by the total amount of available credit you have across all accounts.

For example, if you have $500 of debt with a $1,000 credit limit, you have a 50% credit utilization ratio. On the other hand, if you have $5,000 of debt with a total credit limit of $20,000, your credit utilization score is only 25% despite having 10 times the amount of debt.

Length of credit history

This measures how long you've had credit accounts open by taking an average of your total accounts. Generally, the longer your credit history, the better your score.

However, this is why opening a new account or closing an old account can cause your credit score to dip — because the average age of all accounts will drop.

Types of credit

Having a mix of credit accounts, such as credit cards, loans and a mortgage, can improve your credit score.

Recent credit inquiries

Applying for too much credit at once can negatively impact your score. This is why you shouldn’t, for example, shop for a car loan or personal loan in the middle of getting a mortgage.

» MORE: What affects your credit score?

VantageScore vs. FICO score

VantageScore and FICO provide two well-known credit score measurements. All credit scores analyze the same information from your credit report, but the difference between FICO and VantageScore comes from the way the companies use the information and how much weight they put on different factors, like payment history and the age of your accounts.

“Most lenders still prefer to use the FICO score, which is used in 90% of lending decisions in the United States,” said Tayne. However, “consumers should be concerned with both, as many lenders use VantageScore when making lending decisions. Scores can vary between FICO and VantageScore because of the different scoring models.”

Tayne also explained that these two scoring models count multiple credit inquiries differently.

“VantageScore treats multiple credit inquiries made within 14 days, even for different loan types, as a single inquiry, where FICO scores count each inquiry, regardless of the time frame,” she said.

FAQ

What is a good credit score for my age?

Typically, younger individuals have lower credit scores because they have not had much time to build a credit history. However, even if you are in your early 20s, you can achieve a good or excellent credit score by making regular, on-time payments and opening new lines of credit responsibly.

Is it OK to check your credit score?

Yes, checking your credit score is not the same action as a lender pulling your credit to check for financing approval. You are able to check your credit score often without consequence and can also access your credit report from each of the three main credit bureaus once per year.

What raises your credit score?

Generally, regular, on-time payments to your creditors will promote a healthy credit score. To raise your FICO score, you can pay off some of your debt or ask for a credit increase on one of your credit cards to improve your credit utilization rate, which contributes toward 30% of your score.

Bottom line

Your credit score is a major factor in lending decisions. If you plan to make large purchases that require credit, like financing a new car or obtaining a mortgage, your credit score will be important. A good credit score helps to ensure you’ll not only be approved for a loan but that you'll also get optimal terms and conditions, like lower interest rates.

Article sources

- Equifax, " Are FICO Scores and VantageScore Different? " Accessed March 18, 2023.

- Equifax, “ What is a Good Credit Score? ” Accessed March 20, 2023.

- FICO, “ What’s in my FICO Scores? ” Accessed April 5, 2023.

- VantageScore Solutions, “ The Complete Guide to Your VantageScore .” Accessed April 5, 2023.

You’re signed up

We’ll start sending you the news you need delivered straight to you. We value your privacy. Unsubscribe easily.